Explore the world of Bitcoin with our friendly guide. Understand its power, benefits, and how it’s shaping the future of finance. Dive in today!

Welcome to the world of Bitcoin, a digital currency that is changing the way we think about finance. Bitcoin is disrupting traditional banking systems, making transactions faster, more secure, and cheaper. It’s no wonder that Bitcoin is gaining popularity among individuals and businesses around the world.

In this guide, we’ll introduce you to the power and potential of Bitcoin. We’ll explore the fundamentals of Bitcoin, its advantages, potential risks, and opportunities. Additionally, we’ll discuss Bitcoin investments, mining, its impact on the global economy, regulatory considerations, advancements in Bitcoin technology, and the future outlook for this revolutionary digital currency.

Key Takeaways:

- Bitcoin is revolutionizing the way we think about finance.

- Bitcoin is disrupting traditional banking systems, making transactions faster, more secure, and cheaper.

- Bitcoin has numerous advantages, including enhanced security and privacy, lower transaction costs, and global accessibility.

- Bitcoin investments have the potential to generate substantial returns, but there are risk factors to consider.

- Bitcoin mining is the process of validating transactions and securing the network.

What is Bitcoin?

Bitcoin is a decentralized digital currency that uses encryption techniques to control its creation and transactions. The cryptocurrency operates without a central bank or other intermediary and can be transferred directly from person to person on a peer-to-peer network.

The technology behind Bitcoin is called blockchain, which is a distributed ledger that records all transactions and ensures their integrity. This means that each transaction is verified and cannot be altered without consensus from the network.

Bitcoin has gained popularity due to its ability to operate outside traditional financial systems and provide users with greater autonomy and privacy.

The Advantages of Bitcoin

If you’re looking for an alternative to traditional financial systems, Bitcoin offers several benefits that make it an attractive option for individuals and businesses alike.

Enhanced security and privacy

Bitcoin transactions are secured through the use of cryptography, making them virtually impossible to counterfeit or manipulate. Additionally, Bitcoin’s decentralized nature eliminates the need for a middleman, such as a bank, to process transactions. This reduces the risk of sensitive financial data being compromised by cybercriminals or unauthorized third parties.

Lower transaction costs

Thanks to its peer-to-peer network, Bitcoin transactions are typically faster and less expensive than those conducted through traditional payment systems. This is especially beneficial for cross-border transactions, which can involve high fees and lengthy wait times. With Bitcoin, you can send money anywhere in the world quickly and at a fraction of the cost of traditional methods.

Global accessibility

Bitcoin is a truly global currency, which can be accessed and used by anyone with an internet connection, regardless of geographic location or government-issued currency. This makes it an attractive option for individuals in countries with unstable or restricted banking systems, as well as for businesses looking to expand their customer base beyond national borders.

Increased financial control

By using Bitcoin, individuals and businesses gain greater control over their financial transactions. Bitcoin offers greater financial freedom and independence from traditional banking systems, which can be cumbersome and restrictive. With Bitcoin, you have the ability to send and receive money on your own terms, without the interference of financial intermediaries.

Overall, the benefits of Bitcoin make it a compelling option for those looking to free themselves from traditional banking systems and gain greater financial control. Whether you’re an individual or a business, Bitcoin offers a host of advantages that can make your financial transactions faster, more secure, and less expensive.

Investing in Bitcoin

Bitcoin’s meteoric rise has attracted the attention of investors worldwide. Its potential for generating substantial returns has made it a popular investment choice. If you’re considering investing in Bitcoin, here’s what you need to know:

Investment Strategies

There are several strategies you can use when investing in Bitcoin. One approach is to buy and hold Bitcoin, also known as HODLing, with the expectation that its value will increase over time. Another strategy is day trading, where you buy and sell Bitcoin within a short timeframe to take advantage of market fluctuations.

Risk Factors

As with any investment, Bitcoin carries some risk. Its volatile nature means that its value can fluctuate rapidly, leading to substantial losses. Additionally, Bitcoin’s regulation is still evolving, and it faces potential legal challenges. Therefore, it’s essential to do your research and understand the risks before investing in Bitcoin.

Generating Returns

If you invest wisely, Bitcoin can be a lucrative investment. One way to generate returns is through the appreciation of Bitcoin’s value. Another way is through Bitcoin mining, where you can earn newly created Bitcoins as a reward for verifying transactions on the network.

Overall, Bitcoin has become a popular investment choice due to its potential for generating substantial returns. However, it’s essential to do your due diligence and understand the risks associated with investing in this digital currency.

Bitcoin Mining

If you are wondering how new bitcoins come into existence, the answer lies in Bitcoin mining. This process involves solving complex mathematical equations to validate and process Bitcoin transactions. Miners are incentivized for their work by receiving newly minted bitcoins as a reward.

But what does Bitcoin mining really entail? Essentially, miners compete to be the first to solve the mathematical equation and receive the reward. This is done by using specialized computer hardware to process the equations as quickly as possible.

Bitcoin mining also plays a crucial role in securing the Bitcoin network. This is because miners verify transactions and add them to the blockchain – a decentralized public ledger that records all Bitcoin transactions. By doing so, miners help prevent fraud and ensure that the currency remains decentralized.

The mining process is becoming increasingly complex as more miners join the network, and as such, it requires more computational power to solve the equations. In fact, the difficulty of mining adjusts itself over time to ensure that a new block is produced roughly every ten minutes.

The Environmental Impact of Bitcoin Mining

One of the criticisms of Bitcoin mining is its environmental impact. The energy required to power the specialized hardware needed for mining is significant, leading some to argue that Bitcoin mining is not sustainable in the long run.

However, there are efforts underway to minimize the environmental impact of Bitcoin mining. Some miners are exploring the use of renewable energy sources, such as solar and hydroelectric power, to power their mining operations.

The Future of Bitcoin Mining

As the number of bitcoins in circulation reaches its limit, mining rewards will decrease, and eventually, no new bitcoins will be generated. This means that miners will have to rely on transaction fees to earn a profit.

Despite the challenges, Bitcoin mining is still a popular and lucrative activity for many individuals and businesses. The mining process provides an important role in securing the Bitcoin network, and it will likely continue to be a significant part of the Bitcoin ecosystem for many years to come.

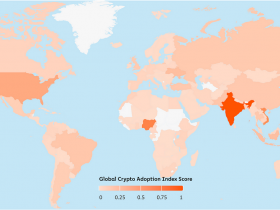

Bitcoin’s Impact on the Global Economy

Bitcoin is a digital currency that has the potential to revolutionize the global economy. Its decentralized nature, lower transaction costs, and global accessibility make it an attractive alternative to traditional financial systems.

One of the ways Bitcoin is impacting the global economy is through cross-border transactions. With Bitcoin, individuals and businesses can quickly and easily send and receive funds across international borders without the need for expensive intermediaries such as banks or payment processors. This has the potential to make global trade more efficient and accessible to a wider audience.

Another way Bitcoin is impacting the global economy is through financial inclusion. In many parts of the world, traditional financial systems are either unreliable or not accessible to the majority of the population. Bitcoin, on the other hand, is accessible to anyone with an internet connection and a mobile device. This has the potential to bring financial services to underserved communities around the world.

“Bitcoin has the potential to make global trade more efficient and accessible to a wider audience.”

However, Bitcoin is not without its challenges in the global economy. Its volatile price, lack of regulation, and potential for use in illicit activities have raised concerns among governments and regulators around the world. As a result, some countries have implemented strict regulations on Bitcoin and other cryptocurrencies to mitigate these risks.

Despite these challenges, the potential benefits of Bitcoin for the global economy are significant. As more individuals and businesses adopt Bitcoin, the impact on the global financial landscape will continue to grow.

Regulation and Legal Considerations

Bitcoin’s decentralized nature presents unique challenges when it comes to regulation and legal considerations. As governments and regulatory bodies attempt to navigate this rapidly evolving landscape, it’s important for individuals and businesses to understand key factors affecting Bitcoin’s legal status.

One major debate surrounding Bitcoin is whether it should be considered a currency or a commodity. Currently, the U.S. Commodity Futures Trading Commission (CFTC) classifies Bitcoin as a commodity, while the Internal Revenue Service (IRS) treats it as property for tax purposes. This lack of uniform regulation can be a challenge for businesses looking to incorporate Bitcoin into their operations.

Government Policies

Government policies towards Bitcoin vary widely around the globe. While some countries have embraced the digital currency, others have banned it outright.

For example, in 2013, China’s central bank banned financial institutions from processing Bitcoin transactions, but allowed individuals to hold and trade the currency. On the other hand, Japan passed a law in 2017 recognizing Bitcoin as a legal method of payment.

Given this uneven legal landscape, it’s important for individuals and businesses to stay up-to-date on the latest regulations and policies in their respective regions.

Legal Considerations

Bitcoin’s anonymity and lack of centralized authority have also raised concerns about its use in illicit activities such as money laundering and terrorism financing. As a result, governments and regulatory bodies have taken steps to combat these issues, such as requiring exchanges to register as money service businesses and imposing strict reporting and compliance requirements.

Additionally, individuals and businesses that deal with Bitcoin may face legal risks, such as potential liability under anti-money laundering and know-your-customer regulations. It’s important to seek legal advice and adhere to best practices in order to reduce such risks.

Despite these challenges, Bitcoin continues to gain acceptance as a legitimate form of payment and investment. By staying informed about the legal landscape surrounding Bitcoin, individuals and businesses can make informed decisions about utilizing this powerful technology.

Innovations in Bitcoin Technology

The world of Bitcoin is constantly evolving, with new innovations emerging all the time. These advancements are expanding the utility of Bitcoin and driving its adoption by individuals and businesses alike. In this section, we will explore some of the most exciting innovations in Bitcoin technology.

The Lightning Network

The Lightning Network is a second layer solution built on top of the Bitcoin blockchain. Its purpose is to increase the speed and scalability of Bitcoin transactions. The Lightning Network allows users to create payment channels between themselves, enabling rapid and low-cost transactions, while reducing traffic on the main Bitcoin network.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. These contracts run on the blockchain and can be used with Bitcoin to enforce the rules of the agreement, automatically performing the actions specified in the contract when certain conditions are met. This innovation has the potential to disrupt traditional legal contracts by providing a faster, more secure, and more transparent alternative.

Decentralized Applications (DApps)

Decentralized applications, or DApps, are built on blockchain technology, and operate peer-to-peer, with no centralized authority. These applications have the potential to revolutionize a wide range of industries, including finance, healthcare, and voting systems, by providing secure, transparent, and tamper-proof systems. Many DApps operate using Bitcoin, making it a crucial part of their infrastructure.

Improved Privacy

Bitcoin’s privacy features, which were once considered weak, have improved significantly in recent years. Innovations like confidential transactions and Schnorr signatures make it much harder for outsiders to trace transactions and identify the parties involved. Improved privacy features will be crucial for businesses to adopt Bitcoin on a larger scale, while also providing increased protection for individual users.

These are just a few examples of the exciting innovations happening in the world of Bitcoin technology. As more developers and entrepreneurs get involved, it is likely that even more groundbreaking ideas will emerge.

Future Outlook for Bitcoin

Bitcoin has come a long way since its inception in 2009. While it has faced its fair share of criticisms and volatility, the future prospects for this pioneering cryptocurrency look incredibly promising. Its value continues to surge, and the number of investors and businesses adopting it as a payment method is growing by the day.

The potential for diversification

As Bitcoin’s market capitalization grows, so too does its potential for diversification. This digital currency may eventually stand alongside established assets such as stocks, bonds, and precious metals, offering a reliable option for investors seeking a diversified portfolio.

Further innovation in the pipeline

Bitcoin is not without its challenges, but the community is continuously working on innovative solutions to overcome them. One such solution is the Lightning Network, a layer-two scaling solution that seeks to reduce congestion and transaction costs. The versatility of Bitcoin as a platform for developing Decentralized Applications (DApps) and smart contracts is also an exciting area of development.

Regulatory clarity

The regulatory environment surrounding Bitcoin remains somewhat ambiguous, creating a degree of uncertainty. However, we have seen progress in recent years, with governments and regulatory bodies establishing more clarity on the legal status of cryptocurrencies.

Increased adoption

The adoption of Bitcoin is likely to continue at a rapid pace, taking it from a niche asset to a mainstream form of payment. With an ever-growing number of merchants accepting Bitcoin as a payment method, the currency’s global reach is expanding, increasing its utility and appeal among consumers.

Institutional backing

The steady influx of institutional investment in Bitcoin is another indicator of its long-term viability and future success. The entry of major companies and financiers into the market provides a significant vote of confidence in Bitcoin’s potential as an asset class.

All things considered, the future of Bitcoin looks incredibly promising. Its impact on the global financial landscape cannot be underestimated, and it remains a groundbreaking and transformative technology with huge potential. Now is a great time to invest in Bitcoin and be part of this exciting journey as it continues to evolve.

Conclusion

Congratulations on completing this guide to the power of Bitcoin! You have gained a deeper understanding of the fundamentals of Bitcoin, its advantages, investment opportunities, mining, impact on the global economy, regulation, technological innovations, and future potential.

As you can see, Bitcoin is much more than just a digital currency; it’s a revolutionary technology with the potential to transform the way we think about finance and conduct business.

So, whether you’re a business owner, investor, or simply curious about Bitcoin, we encourage you to embrace this transformative technology and stay informed about emerging trends and developments.

By staying up-to-date with the latest news and insights, you can position yourself to take advantage of the many opportunities that Bitcoin has to offer.

In conclusion, we hope this guide has provided useful information and inspiration to explore the world of Bitcoin further. Thank you for reading, and we wish you all the best in your Bitcoin journey!

FAQ

What is Bitcoin?

Bitcoin is a digital currency that operates on a decentralized network called blockchain. It allows for secure, peer-to-peer transactions without the need for intermediaries like banks.

How does Bitcoin work?

Bitcoin works through a technology called blockchain, which records and verifies all transactions. When you send Bitcoin to someone, the transaction is added to a block, which is then added to the blockchain. Miners validate these transactions, ensuring their accuracy and security.

What are the advantages of using Bitcoin?

There are several advantages to using Bitcoin. It offers enhanced security and privacy due to its cryptographic nature. Bitcoin also has lower transaction costs compared to traditional financial systems, and it allows for global accessibility, making it an attractive option for cross-border transactions.

How can I invest in Bitcoin?

There are several ways to invest in Bitcoin. You can buy and hold Bitcoin as a long-term investment, trade Bitcoin on cryptocurrency exchanges, or invest in Bitcoin-related companies. It’s important to research and understand the risks involved before investing.

What is Bitcoin mining?

Bitcoin mining is the process of validating transactions and adding them to the blockchain. Miners use specialized hardware to solve complex mathematical problems that secure the network. In return for their efforts, miners are rewarded with newly created Bitcoins.

How is Bitcoin impacting the global economy?

Bitcoin is reshaping the global economy in various ways. It has the potential to disrupt traditional banking systems by offering an alternative form of digital currency. Bitcoin also facilitates cross-border transactions with lower fees and faster settlement times, providing financial inclusion to the unbanked population.

What are the legal considerations and regulations surrounding Bitcoin?

The regulatory landscape for Bitcoin is evolving. Different countries have different approaches to regulating cryptocurrencies. It’s important to understand the legal considerations and government policies in your jurisdiction, as some countries may have restrictions or requirements for using or trading Bitcoin.

What are the latest innovations in Bitcoin technology?

Bitcoin technology is constantly evolving. Innovations like the lightning network, which enables faster and cheaper transactions, and smart contracts and decentralized applications (DApps), which expand Bitcoin’s functionality, are driving adoption and expanding its utility.

What is the future outlook for Bitcoin?

The future of Bitcoin holds promise and potential, but also risks. Emerging trends like increased institutional adoption and regulatory clarity may lead to broader acceptance. However, there are also concerns about scalability, energy consumption, and potential government interventions. It’s important to stay informed and make educated decisions about Bitcoin’s future.