Explore the world of Cryptocurrency with our informative guide. Learn how to leverage this digital asset for maximum potential. Don’t miss out!

Cryptocurrency has transformed the financial landscape, attracting investors and businesses alike. While this digital asset has the potential to revolutionize the way we conduct transactions, it can also be a complex and volatile market to navigate. That’s where this guide comes in. Here, we’ll provide valuable information and tips for leveraging cryptocurrency effectively, whether you’re a seasoned investor or just starting out.

Key Takeaways

- Cryptocurrency has the potential to transform the financial landscape, but navigating the market can be complex.

- This guide aims to provide valuable information and tips for leveraging cryptocurrency effectively.

- Topics explored in this guide include: what cryptocurrency is and how it works, types of cryptocurrencies available, getting started with cryptocurrency, investing in cryptocurrency, benefits and risks, mining, regulations, secure storage, taxes, real-world applications, security and privacy, future outlook, and tips for successful trading.

- To navigate the cryptocurrency market successfully, it’s important to stay informed, cautious, and continuously learning.

- Cryptocurrency can contribute to financial inclusion by providing access to banking services for the unbanked population.

What is Cryptocurrency?

Cryptocurrency is a digital asset that uses encryption techniques to secure transactions and create new units. It operates on decentralized networks that allow peer-to-peer transactions without intermediaries like banks or government institutions. Cryptocurrency is based on a technology called blockchain, which is a distributed ledger that records all transactions and ensures their immutability.

Cryptocurrency tokens can be used for different purposes, including as a medium of exchange, a store of value, or a utility token that provides access to a specific service or product.

The first cryptocurrency in the world was Bitcoin, which was created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. Since then, thousands of cryptocurrencies have emerged, with different features, use cases, and market capitalization.

The Basic Principles of Cryptocurrency

Cryptocurrency is based on several fundamental principles that differentiate it from traditional fiat currency:

- Decentralization: Cryptocurrency operates on decentralized networks that are not controlled by any central authority or institution. This makes cryptocurrency transactions immune to censorship or alteration by third parties.

- Encryption: Cryptocurrency transactions are secured using complex encryption algorithms that ensure the privacy and security of users’ digital assets.

- Digital tokens: Cryptocurrency tokens are digital assets that represent a specific unit of value and can be transferred between individuals or organizations. Each token is unique and cannot be duplicated or counterfeited.

The Role of Blockchain Technology

The cornerstone of cryptocurrency is blockchain technology, which is a decentralized and distributed ledger that records all transactions in a secure and transparent manner. Blockchain is a chain of blocks that contains information about each transaction, including its timestamp, participants, and crypto amount. It is maintained by a network of nodes that verify and validate each transaction before adding it to the block.

One of the key features of blockchain is its immutability, which means that once a transaction is recorded on the blockchain, it cannot be altered or deleted. This makes blockchain technology one of the most secure and transparent systems for recording transactions.

Types of Cryptocurrencies

With over 10,000 cryptocurrencies available in the market today, classifying and categorizing them can be a daunting task. However, the majority of cryptocurrencies can be grouped into three main categories:

| Type | Description |

| Bitcoin-based cryptocurrencies | The first and most popular cryptocurrency, Bitcoin, inspired the creation of other digitally encrypted currencies with similar names, such as Bitcoin Cash and Bitcoin Gold. |

| Platform-based cryptocurrencies | Cryptocurrencies created on a blockchain platform, such as Ethereum, which is used to build smart contracts and decentralized applications (dApps). |

| Privacy-based cryptocurrencies | Cryptocurrencies that prioritize anonymity and privacy, such as Monero, Zcash, and Dash. |

The cryptocurrency market is highly volatile and constantly evolving. Thus, it is essential to conduct thorough research and analysis before investing in any cryptocurrency.

Getting Started with Cryptocurrency

If you’re new to cryptocurrency, getting started may seem daunting. Don’t worry, we’ve got you covered! Here are some simple steps you need to follow:

- Choose a cryptocurrency wallet: A cryptocurrency wallet is a software or hardware where you can store your digital assets. Choose a wallet that’s user-friendly and secure. Examples include MyEtherWallet, Ledger Nano S, and Trezor.

- Select a cryptocurrency exchange: To buy or sell cryptocurrency, you need to use an exchange. Choose a reputable exchange that fits your requirements and offers the cryptocurrencies you want to trade. Examples include Coinbase, Binance, and Kraken.

- Secure your wallet: Once you have a wallet and have chosen an exchange, make sure to secure it. Use two-factor authentication and create a strong password that you can remember, but others cannot guess.

- Buy cryptocurrency: After setting up your wallet and exchange account, you’re ready to buy cryptocurrency. Different exchange platforms have different methods of payment. Choose the one that’s most convenient for you.

- Start trading: Now that you have cryptocurrency in your wallet, you can start trading. Remember, the cryptocurrency market is highly volatile, so start by trading with small amounts.

Remember, the key to success in this market is doing your research and learning as much as you can. Be patient, stay informed, and enjoy the ride!

Investing in Cryptocurrency

Investing in cryptocurrency can be an exhilarating experience, but it’s important to do your due diligence. Here are some tips to help you get started:

- Build a strong foundation of knowledge: Educate yourself on the market trends, trading strategies, and risk management techniques. Reading books, attending webinars, and joining forums can be excellent resources.

- Choose a reliable trading platform: Research different exchanges and trading apps to find the one that best fits your needs. Check the reviews, fees, and security features before committing to an exchange.

- Start with a small investment: It’s always a good idea to start with a small investment and test the waters. Gradually increase your investment as you get more comfortable with the market.

- Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize risks. Investing in a single cryptocurrency can be risky, given the volatile nature of the market.

- Monitor the market: Keep tabs on the market trends and study the price charts to identify potential opportunities. Use stop-loss orders to minimize losses in case the market shifts unexpectedly.

- Set realistic expectations: Cryptocurrency trading is not a get-rich-quick scheme. Be realistic with your expectations and avoid chasing profits blindly. Successful trading requires patience, persistence, and discipline.

Remember, investing in cryptocurrency involves high risk, and there are no guarantees for profit. However, with the right mindset, knowledge, and tools, you can increase your chances of success.

Benefits and Risks of Cryptocurrency

Cryptocurrency has emerged as a lucrative investment opportunity for many, with its decentralized nature, low fees, and potential for high returns. However, like any investment, it comes with its own set of risks and benefits.

Benefits of Cryptocurrency

One of the primary benefits of cryptocurrency is its fast transaction speed. Transactions can be completed in a matter of minutes, making it a convenient option for those who need to send or receive money quickly.

Another benefit is the low transaction fees associated with cryptocurrency transactions. Traditional financial institutions often charge high fees for transactions, while cryptocurrency transactions usually involve minimal fees.

Cryptocurrency also offers the potential for high returns, with some coins experiencing significant value appreciation over time. For example, the value of Bitcoin has grown exponentially since its inception, making early adopters very wealthy.

Risks of Cryptocurrency

Despite its benefits, cryptocurrency is not without its risks. One of the primary risks is price volatility. Cryptocurrency prices can fluctuate wildly in a short period, making it a highly volatile market. This means that investors need to be prepared for sudden and significant changes in the value of their investments.

Another risk is the lack of regulatory oversight. Cryptocurrency is not currently regulated by any government or financial institution, which leaves investors exposed to potential fraud and scams.

There is also the risk of security threats. While transactions are encrypted and secure, hackers can target cryptocurrency exchanges or individual wallets, stealing digital assets and causing significant financial loss.

Investors need to carefully consider both the potential benefits and risks associated with investing in cryptocurrency before getting started.

Cryptocurrency Mining

Cryptocurrency mining is the process of verifying transactions on a blockchain network and adding them to the public ledger. This process is essential to maintaining the integrity of the network and creating new digital tokens as a reward for miners. To mine cryptocurrency, you need specialized hardware and software that can solve complex mathematical equations in a process called proof-of-work.

The most popular cryptocurrency to mine is Bitcoin, but other digital currencies, such as Ethereum, Litecoin, and Monero, are also mineable. The profitability of mining depends on several factors, such as the cost of electricity, the difficulty level of the network, and the price of the cryptocurrency. Mining can be a lucrative venture for experienced miners with access to cheap electricity and specialized equipment, but it also requires a significant investment of time, resources, and knowledge.

Mining Hardware

The hardware required for mining varies depending on the cryptocurrency. Bitcoin mining, for example, requires specialized equipment called ASICs (Application-Specific Integrated Circuits) that are designed to perform the complex calculations required for proof-of-work. Other cryptocurrencies, such as Ethereum, can be mined using GPUs (Graphics Processing Units) commonly found in gaming computers.

The cost of mining hardware can vary greatly, with ASICs ranging from hundreds to thousands of dollars, and GPUs costing several hundred dollars each. In addition to the upfront cost of hardware, miners also need to take into account ongoing expenses such as electricity, cooling, and maintenance.

Mining Pools

Mining pools are groups of miners who combine their resources to increase their chances of solving the mathematical equations required for proof-of-work. By pooling their resources, miners can share the rewards more evenly and reduce the volatility of payouts. Joining a mining pool can be a good option for novice miners or those with limited resources.

The Future of Mining

Mining is an essential part of the cryptocurrency ecosystem, but it also has a significant impact on the environment due to the energy-intensive nature of the process. Some cryptocurrencies, such as Ethereum, are exploring alternative consensus mechanisms that require less energy, such as proof-of-stake. While the future of mining is uncertain, it is likely that the industry will continue to evolve and adapt to new technologies and regulatory frameworks.

Cryptocurrency Regulations: Navigating the Legal Status of Cryptocurrency

As cryptocurrency continues to gain popularity, governments and financial institutions around the world are implementing regulations to ensure its safe and lawful use. However, the legal status of cryptocurrency varies widely among countries, with some embracing it as a legitimate asset class while others remain skeptical or hostile towards it.

In the United States, cryptocurrency is subject to a complex regulatory framework that involves multiple government agencies and laws. The Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes, meaning that capital gains taxes may apply to transactions involving cryptocurrency. The Securities and Exchange Commission (SEC) requires some types of cryptocurrency offerings to be registered as securities, while the Commodity Futures Trading Commission (CFTC) regulates cryptocurrency derivatives and futures.

Other countries have taken different approaches to cryptocurrency regulations. Japan, for example, recognizes Bitcoin as a legal form of payment and has implemented licensing requirements for cryptocurrency exchanges. In contrast, China has banned initial coin offerings (ICOs) and cryptocurrency trading, citing concerns about fraud and speculative trading.

It is important to stay informed about the cryptocurrency regulations in your country and to comply with all applicable laws and regulations. Failure to do so can result in legal penalties, fines, or other consequences.

The Impact of Regulations on the Cryptocurrency Market

Cryptocurrency regulations can have a significant impact on the market by affecting adoption rates, investment flows, and price volatility. Some investors may be deterred by strict regulatory requirements, while others may be attracted to a regulated market that provides greater stability and transparency. Increased regulatory scrutiny can also lead to improvements in security and risk management practices, making cryptocurrency a safer and more accessible asset for everyone.

The Future of Cryptocurrency Regulations

As the cryptocurrency market continues to evolve, governments and policymakers will face new challenges in regulating this innovative and rapidly changing industry. It is likely that regulations will become more standardized and consistent across different countries, but there may also be new types of cryptocurrency that require novel regulatory frameworks. Ultimately, the future of cryptocurrency regulations will depend on a variety of factors, including technological advancements, market trends, and geopolitical developments.

“Regulations are essential to ensure that cryptocurrency is used in a transparent and responsible manner, while protecting investors and consumers from fraud and other risks. As the cryptocurrency market continues to mature, we can expect to see more robust and effective regulatory frameworks that promote innovation and stability.”

Secure Storage of Cryptocurrency

One of the most critical aspects of investing in cryptocurrency is ensuring the safe storage of your digital assets. As cryptocurrencies exist solely in digital form, they are vulnerable to hacking and theft. Therefore, it is essential to employ a secure storage method to protect against potential losses.

Cold Wallets

Cold wallets are hardware devices designed explicitly for the safe storage of cryptocurrencies. Unlike online or hot wallets, which are connected to the internet and thus susceptible to cyber attacks, cold wallets operate offline, making them more secure.

One popular type of cold wallet is the Trezor Model T. It employs advanced security features such as multi-factor authentication, password protection, and digital signature verification to keep your digital assets safe. Another trustworthy option is the Ledger Nano X, which uses a secure chip to store private keys and a 24-word recovery phrase, ensuring backup and recovery in case the device is lost or damaged.

| Cold Wallet | Pros | Cons |

| Trezor Model T | – Advanced security features – Supports multiple cryptocurrencies | – Higher cost compared to hot wallets – Limited screen size and functionality |

| Ledger Nano X | – Secure chip technology – Easy-to-use interface | – Initial setup can be complicated – Limited storage capacity |

It is recommended to store your cold wallet in a secure location such as a safe or safety deposit box. Additionally, it is crucial to backup your private keys and recovery phrase and keep them in a separate secure location to avoid losing access to your digital assets.

Overall, using a cold wallet is the safest and most reliable option for storing your cryptocurrency. By taking the necessary precautions and following best practices, you can ensure the secure and hassle-free management of your digital assets.

Cryptocurrency and Taxes

As with any investment, trading or use of cryptocurrency may have tax implications depending on your location and the specific transactions involved. It is important to understand the tax regulations surrounding cryptocurrency to ensure you are compliant and avoid any penalties or fines.

Cryptocurrency taxes in the United States

In the United States, the Internal Revenue Service (IRS) considers cryptocurrency to be property rather than currency, meaning it is subject to tax laws that apply to property transactions. This includes capital gains tax on profits made from selling or exchanging cryptocurrency. However, losses incurred from cryptocurrency trades can also be deducted.

When receiving cryptocurrency as payment, it is also considered taxable income and should be reported on your tax return. The value of cryptocurrency received should be reported in US dollars based on the fair market value at the time of receipt.

Tax reporting requirements

The IRS requires taxpayers to report all cryptocurrency transactions, including the date of acquisition, fair market value at the time of acquisition, date of sale or exchange, and fair market value at the time of sale or exchange. These details should be reported on Form 8949 and included in your tax return.

If you are paid in cryptocurrency for services provided, this income is also subject to self-employment tax. The value of the cryptocurrency received should be reported on Schedule C of Form 1040.

International tax regulations

Cryptocurrency tax regulations vary by country and jurisdiction. Some countries have specific laws and regulations in place, while others have yet to provide clear guidance on how to tax cryptocurrency transactions. It is important to research and understand the tax laws in your country or jurisdiction to ensure you are compliant.

It is recommended to consult with a tax professional who has experience with cryptocurrency tax regulations to ensure you are complying with all applicable laws and regulations.

Real-World Applications of Cryptocurrency

Cryptocurrency has shown promising potential for revolutionizing traditional systems in various industries and sectors. Here are some real-world applications of cryptocurrency:

| Industry/Sector | Application of Cryptocurrency |

| Finance | Cryptocurrency can facilitate international money transfers, increase financial transparency, and enable access to banking services for the unbanked population. |

| Supply Chain Management | Cryptocurrency can streamline supply chain processes by enabling real-time tracking of products, improving inventory management, and reducing fraud. |

| Healthcare | Cryptocurrency can improve healthcare data management systems by ensuring data privacy and interoperability, and enabling secure and transparent sharing of medical records. |

| Gaming | Cryptocurrency can enhance gaming experiences by enabling in-game purchases, facilitating online transactions, and enabling secure and decentralized gaming platforms. |

Other potential applications of cryptocurrency include voting systems, social media platforms, and energy management systems. As more individuals and businesses recognize the benefits of cryptocurrency, its adoption is likely to grow, creating new possibilities for innovation and disruption.

Cryptocurrency Security and Privacy

The security and privacy of cryptocurrency transactions are crucial factors that impact their adoption and use. As cryptocurrency transactions are decentralized and irreversible, they are susceptible to various security threats, such as hacking, theft, and fraud.

To ensure the security of your cryptocurrency assets, it is essential to use a reliable and secure cryptocurrency wallet that employs advanced encryption techniques and multi-factor authentication. Cold wallets, such as hardware wallets and paper wallets, provide the highest level of security as they store your digital assets offline, protecting them from online threats.

Another essential aspect of cryptocurrency security is using a secure network and avoiding public Wi-Fi or unsecured networks for transactions. Additionally, strong passwords and private keys must be used to prevent unauthorized access to your wallet and digital assets.

“The security and privacy of cryptocurrency transactions are crucial factors that impact their adoption and use.”

Privacy is another key concern for cryptocurrency users, as blockchain technology makes all transactions public and traceable. However, many cryptocurrencies, such as Monero and Zcash, offer privacy features that conceal the identity of the sender, receiver, and transaction details.

Protecting Your Privacy in Cryptocurrency Transactions

Privacy-focused cryptocurrencies use advanced encryption techniques, such as stealth addresses and ring signatures, to obscure transaction details and maintain anonymity. Using a cryptocurrency mixer, such as CoinJoin, can also help enhance privacy by mixing multiple transactions and making it difficult to trace individual transactions.

It is essential to keep up-to-date with the latest security and privacy features of the cryptocurrency wallet you use. Regularly checking for updates and implementing them promptly can help minimize security risks and preserve the privacy of your digital assets.

Future Outlook for Cryptocurrency

The world of cryptocurrency is constantly evolving, and the future looks promising for this digital asset. As we move into the next decade, there are several trends and developments that are expected to shape the future of cryptocurrency.

The Rise of Central Bank Digital Currencies

Central banks around the world are exploring the possibility of creating their own digital currencies. These Central Bank Digital Currencies (CBDC) would be backed by the government and offer several benefits over traditional fiat currencies, including faster transaction times and lower costs. China has already launched a digital Yuan pilot program, and several other countries, including the US, are expected to follow suit in the coming years.

Blockchain Interoperability

Currently, each cryptocurrency operates on its own blockchain, making it difficult to transfer value between different networks. However, several projects are working on developing cross-chain solutions that would allow for interoperability between different blockchain networks. This would enable users to transfer value seamlessly between different cryptocurrencies, making it easier to diversify their portfolio and reduce risk.

Increased Adoption in Traditional Finance

As cryptocurrency becomes more mainstream, traditional finance institutions are taking notice. Several major banks and investment firms have already launched cryptocurrency trading and investment services, and more are expected to follow suit. Additionally, several countries are exploring the possibility of adopting cryptocurrency as a legal tender, further increasing its acceptance as a legitimate form of payment.

| Country | Status |

| El Salvador | Implemented Bitcoin as legal tender in September 2021 |

| Ukraine | Exploring the possibility of legalizing and regulating cryptocurrency |

| Iran | Working on a framework for a national cryptocurrency |

Increased Regulatory Clarity

Regulatory uncertainty has been a major obstacle to the widespread adoption of cryptocurrency. However, several countries are taking steps to provide clear and comprehensive regulations surrounding cryptocurrency transactions. This increased regulatory clarity is expected to increase investor confidence and attract more institutional capital into the space.

Focus on Sustainability

As concerns about climate change continue to grow, the cryptocurrency industry is facing increasing scrutiny over its energy consumption. To address this issue, several projects are working on developing more sustainable and energy-efficient blockchain networks. Additionally, several countries are exploring the possibility of using renewable energy sources to power cryptocurrency mining operations.

Overall, the future of cryptocurrency looks bright. As the industry continues to mature and evolve, we can expect to see increased adoption, innovation, and regulation, further cementing cryptocurrency’s place in the global economy.

Cryptocurrency Trading Tips for Successful Trading Strategies

Trading cryptocurrency can be a profitable endeavor, but it requires adequate preparation and knowledge. Here are some useful tips for successful cryptocurrency trading:

- Research the market: Before investing in any cryptocurrency, research its market capitalization, trading volume, price history, and future outlook. Keep track of the latest news and events that can affect the cryptocurrency market.

- Choose a reliable exchange: Look for a cryptocurrency exchange that has a good reputation, transparent pricing, and robust security measures. Check for any hidden fees or withdrawal limitations that can affect your trading profitability.

- Diversify your portfolio: Avoid investing all your money in one cryptocurrency, as it can lead to higher risk and lower returns. Instead, diversify your portfolio by investing in multiple cryptocurrencies with different features and use cases.

- Set realistic expectations: Cryptocurrency trading is not a get-rich-quick scheme. Set realistic goals and expectations based on your initial investment, risk tolerance, and market analysis.

- Use risk management strategies: To minimize risk, use stop-loss orders, limit orders, and other risk management tools offered by the trading platform. Don’t invest more than you can afford to lose.

- Don’t follow the herd mentality: Avoid making impulsive decisions based on market hype or FOMO (fear of missing out). Instead, use your research and analysis to make informed trading decisions.

- Keep track of your trading performance: Monitor your trading history, profits, losses, and trading fees. Analyze your performance over time and adjust your trading strategies accordingly.

By following these tips and techniques, you can increase your chances of success in cryptocurrency trading. Remember to stay updated on the latest market trends and regulatory developments to make informed and profitable trading decisions.

Cryptocurrency and Financial Inclusion

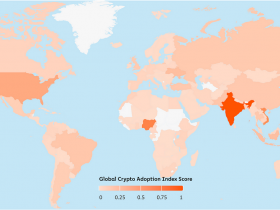

One of the most powerful aspects of cryptocurrency is its potential to promote financial inclusion by providing access to banking services for the unbanked population. In developing countries, where traditional banking infrastructure is lacking, cryptocurrency can be a game-changer.

According to the World Bank, around 1.7 billion adults worldwide do not have access to formal financial services. This makes it incredibly challenging for them to save money, access credit, or invest in their futures. Cryptocurrency can bridge this gap by providing a secure, decentralized, and accessible platform for individuals to manage their finances.

Cryptocurrency Adoption Initiatives

Several initiatives and projects aimed at promoting cryptocurrency adoption in underserved communities have emerged in recent years. One such initiative is the GiveCrypto project, which distributes cryptocurrency to people living in extreme poverty around the world. By sending cryptocurrency directly to beneficiaries, the project aims to bypass middlemen and provide individuals with greater financial autonomy.

Another example is the BitGive Foundation , which supports nonprofit organizations by providing them with cryptocurrency donations. The foundation has partnered with organizations in various sectors, including healthcare, education, and disaster relief, to facilitate the adoption of cryptocurrency in their operations.

Challenges and Opportunities

While the potential of cryptocurrency to promote financial inclusion is vast, there are still significant challenges to overcome. One of the most significant obstacles is the lack of infrastructure and education in many underserved communities. To fully leverage the benefits of cryptocurrency, individuals need access to reliable internet connectivity, digital literacy, and cybersecurity awareness.

Furthermore, there are concerns about the volatility of cryptocurrency prices and their impact on individuals’ financial stability. In response, several stablecoins have emerged in recent years, which aim to provide a more stable alternative to traditional cryptocurrency.

Overall, the potential of cryptocurrency to promote financial inclusion is substantial. As initiatives and projects aimed at promoting cryptocurrency adoption continue to emerge, it is essential to prioritize education, infrastructure, and cybersecurity to ensure that cryptocurrency is a tool for financial empowerment.

Conclusion

In conclusion, cryptocurrency has emerged as a revolutionary financial asset with the potential to transform the way we transact and manage our assets. This guide aimed to provide valuable insights and tips for effectively leveraging cryptocurrency, from understanding its basic principles to investing in it wisely and securely storing it.

It is important to note that while cryptocurrency holds great promise, it is not without risks and challenges. Price volatility, regulatory uncertainties, and security threats remain major concerns that must be addressed. As the cryptocurrency market continues to evolve, it is crucial to stay informed and vigilant while exploring its potential.

We hope that this guide has provided you with the necessary knowledge and tools to navigate the cryptocurrency market with confidence. By staying informed and making informed decisions, you can unlock the power of cryptocurrency and tap into its full potential.

FAQ

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates on decentralized networks. It is not controlled by any central authority, such as a government or financial institution.

What are the types of cryptocurrencies available?

There are various types of cryptocurrencies available in the market, including Bitcoin, Ethereum, Ripple, and Litecoin. Each cryptocurrency has its own unique features and use cases.

How do I get started with cryptocurrency?

To get started with cryptocurrency, you need to set up a cryptocurrency wallet, choose a reliable exchange to buy or trade cryptocurrencies, and ensure the security of your digital assets.

How can I invest in cryptocurrency?

Investing in cryptocurrency involves buying and holding cryptocurrencies with the expectation of profit. It requires understanding market trends, risk management, and using reliable trading platforms and tools.

What are the benefits and risks of cryptocurrency?

Cryptocurrency offers benefits like fast transactions, lower fees, and potential for high returns. However, it also carries risks such as price volatility, regulatory uncertainties, and security threats.

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating and verifying transactions on a cryptocurrency network. It involves solving complex mathematical problems using computer hardware to earn new cryptocurrency tokens as a reward.

What are the regulations surrounding cryptocurrency?

Cryptocurrency regulations vary by country. Governments and financial institutions have imposed regulations to ensure compliance with anti-money laundering (AML) and know your customer (KYC) requirements.

How can I securely store my cryptocurrency?

To securely store your cryptocurrency, you can use hardware wallets, paper wallets, or cold storage solutions. It is important to backup your wallet and keep it offline to protect it from hacks or theft.

What are the tax implications of cryptocurrency?

Cryptocurrency transactions may have tax implications, including capital gains taxes. Tax regulations vary by country, so it is important to understand and comply with the reporting requirements.

How is cryptocurrency being used in the real world?

Cryptocurrency is being implemented in various industries and sectors, including finance, supply chain management, healthcare, and gaming. It has the potential to revolutionize the way transactions are conducted.

How can I ensure the security and privacy of my cryptocurrency?

You can enhance the security of your cryptocurrency transactions by using secure networks, strong passwords, and encryption techniques. It is important to be cautious and vigilant to protect your digital assets.

What does the future hold for cryptocurrency?

The future of cryptocurrency is dynamic and evolving. It is influenced by emerging trends, technological advancements, and regulatory developments. The impact of cryptocurrency on the global economy continues to be an area of study and speculation.

What are some tips for successful cryptocurrency trading?

Successful cryptocurrency trading requires risk management, research, and understanding market dynamics. It is important to continuously learn and stay updated on the latest trends and developments in the cryptocurrency market.

How can cryptocurrency contribute to financial inclusion?

Cryptocurrency has the potential to provide access to financial services for the unbanked population, promoting financial inclusion. Various initiatives and projects are aimed at increasing cryptocurrency adoption in underserved communities.