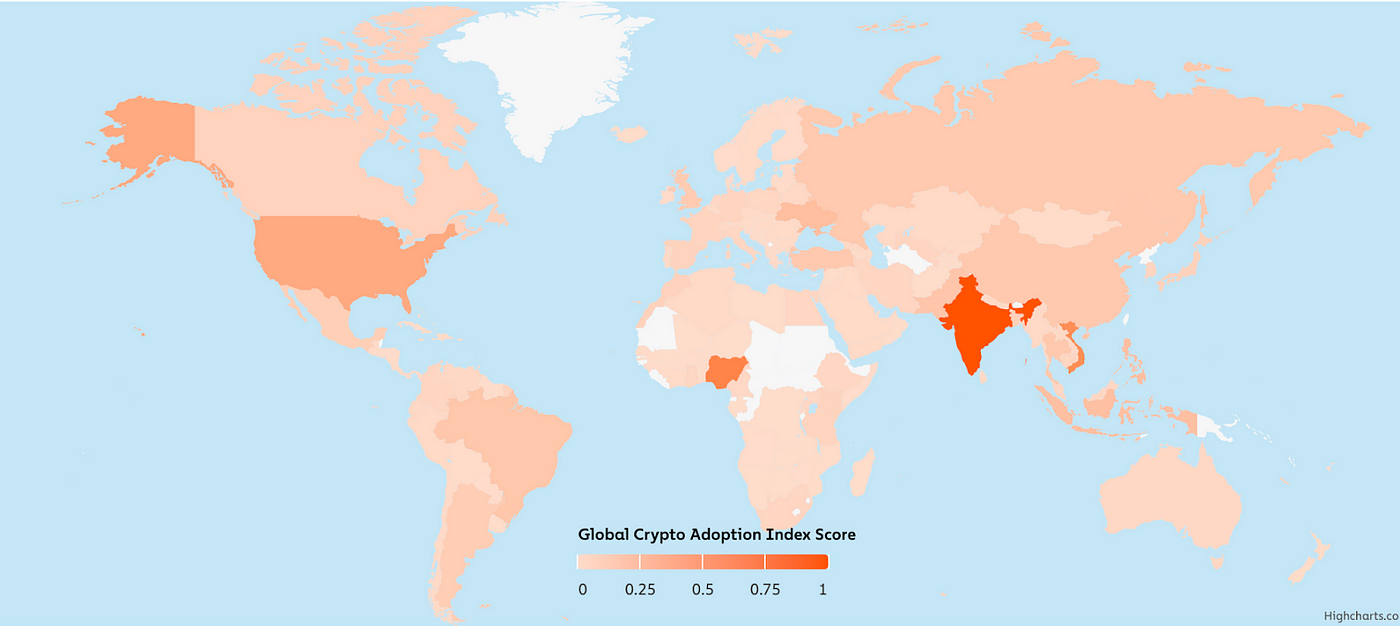

Adoption of crypto-assets has sparked much interest and controversy in recent years. Many people have asked which countries are leading the charge in terms of crypto ownership and digital currency adoption, and the answers may surprise you.

According to Chainalysis’ “2023 Global Crypto Adoption Index“, India, Nigeria, and Vietnam have grabbed the lead, with lower middle-income (LMI) countries demonstrating extraordinary grassroots adoption of crypto-assets. Grassroots adoption refers to countries where normal, everyday people are most enthusiastic about cryptocurrency.

Nigeria is ranked second in the 2023 Global Crypto Adoption Index Top 20 and first in the Chainalysis P2P exchange trading volume ranking.

These countries are at the forefront of the crypto adoption movement, showcasing the various ways in which crypto-assets are being adopted globally. Their rise in the rankings demonstrates the fluid nature of crypto-asset acceptance and its potential to transform global financial landscapes.

While the crypto-asset research acknowledges a drop in global grassroots crypto adoption, a stunning comeback in one critical subset of countries: Lower middle-income (LMI) countries, is worth noting. LMI countries, which constitute for 40% of the global population, have seen rapid rise in cryptocurrency usage. They are the only group of countries where grassroots adoption will stay higher than pre-bull market levels in Q3 2020.

The interaction between grassroots adoption in low- and middle-income (LMI) countries and institutional adoption in high-income (HI) countries may result in a bidirectional crypto-asset adoption trend. This tendency could result in digital assets meeting the specific demands of people in both segments of the global population.

Finally, Chainalysis’ “2023 Global Crypto Adoption Index” provides significant insights into the ever-changing environment of crypto-asset acceptance in countries around the world. As previously stated, Central ,West Africa and Southern Asia and Oceania (CSAO) is the fastest-growing region for adoption, with nations such as India, Nigeria and Vietnam scoring highly. Some emerging themes include increased institutional adoption in high-income nations and retail in low-income ones.

LMI countries are critical in driving grassroots acceptance and the possibility for crypto-assets to become a part of global economies. As digital currencies continue to disrupt the financial environment, it is clear that their impact is worldwide, suggesting a transformative future for finance on a global scale.

Investing in cryptocurrencies is extremely risky and speculative, and this article is not a recommendation by cryptoafricaedu or the author to do so ,because every person’s circumstance is different, a knowledgeable specialist should always be consulted before making any financial decisions.

Cryptoafricaedu is here to provide you with the knowledge you need before entering the market.